Two Out of Three Ain’t Bad, Right? Wrong!

June 5, 2023

June 5, 2023

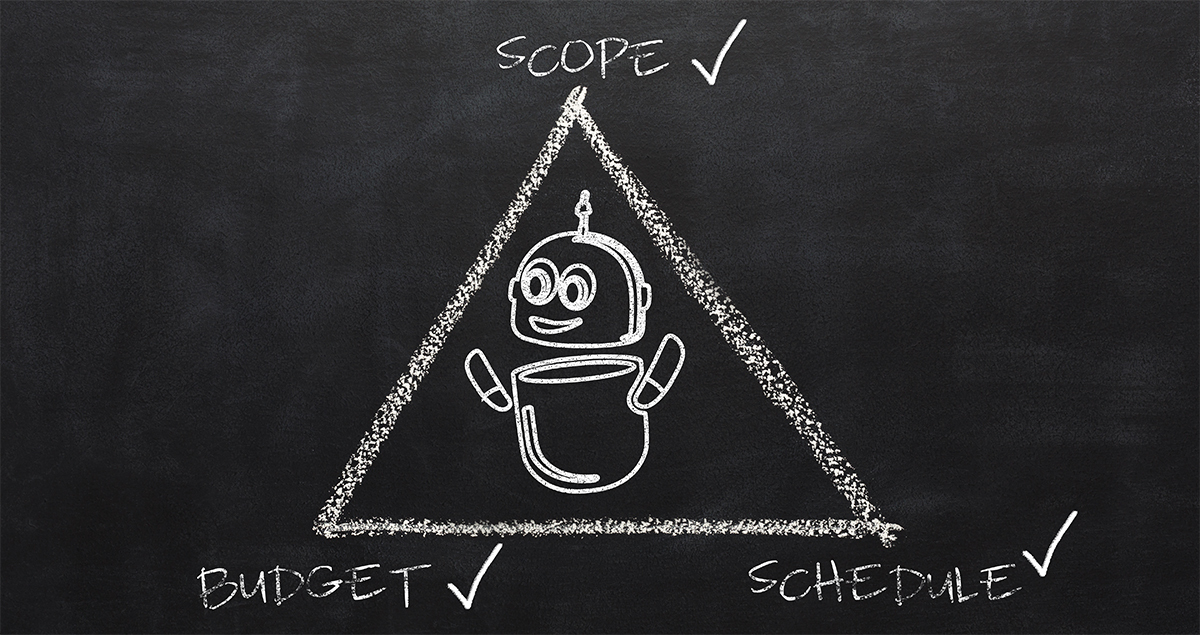

Most project managers are familiar with the tension and interplay between a project’s budget, scope, and schedule. It’s sometimes called the Iron Triangle, because each one of these three things is inevitably constrained by the others. They’re also familiar with reality. The reality that while everyone may want that new project completed on time, at the lowest cost, and with quality results, the experienced project manager knows that only two of those criteria can be realistically met at any given time. You want a project done quickly and with high quality? You got it! Just be ready to pay through the nose. Want the job done well but inexpensively? No problem! Just don’t expect it to be completed anytime soon. Want it quickly and at low cost? Well, it’s probably not going to be any good.

Project managers in almost every industry or market tend to be satisfied if their project meets two out of three of the Iron Triangle’s criteria. Yet there’s one type of project where meeting only one out of three is often considered acceptable. In fact, it’s basically become the standard industry expectation and practice. I’m talking about the tax engine market. Let me explain.

Big global businesses are very careful and risk averse when it comes to changes to their accounting systems like migrating to a newer, more robust tax engine. Why? Because just one small mistake during the migration can snowball and seriously impact the company’s reputation and bottom line. Even if the mistake results in just a few pennies in underpaid taxes per transaction, those pennies can quickly become millions of dollars when multiplied by the thousands of calculations a tax engine processes every day. Even worse? Weeks or months could pass before the company’s accounting team discovers the mistake, and the company could find itself not only having to cover their tax shortfall, but also paying penalties and interest to local tax authorities. And perhaps worst of all, these errors can have an adverse impact their customers, suppliers and partners.

So, when a large company’s CFO is told to hire an outside firm to implement or migrate to a new tax engine, their thought process usually goes something like this: “Well, Big Firm X is going to tell us it will take a team of 10 people 18 months and a couple million in fees to get us up and running on the new engine. And sure, my CEO is going to complain about the time and cost, but once I remind them what’s at stake if the project doesn’t go smoothly, they’ll come around. I mean, it’s Big Firm X! They always get the job done!” This kind of thinking is all too common in corporate accounting, and the bigger the accounting firm the happier they are with the situation, I assure you.

But it doesn’t have to be this way. Today, businesses have access to cutting-edge tech like Modios, our intelligent robotic process automation (RPA) that can automate the tax engine implementation process and get the job done in much less time and lower cost. Oh, and a lot better too, with way more testing and better documentation. And take a look at our Modios Rapid Insight solution; it quickly imports and analyzes your tax engine’s configurations, helps us map the data to your new engine if you’re migrating, and then generates documentation for the updated tax solution. That documentation includes actionable insight and analytics on the performance of your tax engine implementation for more comprehensive performance optimization (if needed). In essence, Cordiance delivers the same, highly reliable results that the big firms do, but at a fraction of the time and cost. In fact, our results are better, but we prefer to underpromise and overdeliver.

I can imagine the CFO I just described would read this and think, “That sounds great, Steve. But can you imagine what my CEO is going to do when I tell him we’re using an automated solution from a small company to migrate our highly complex, multi-national tax engine to a new platform?”

Well, Cordiance has you covered here, too. We used to work for those big accounting firms. So we know exactly what they do and how they do it. We just do it better. And quicker. We also have unique capabilities with our Modios Rapid Insight Plus solution. As mentioned above, Rapid Insight automatically analyzes and documents exactly what’s in your tax engine. With Rapid Insight Plus, our in-house tax experts (many of whom used to work at the largest tax software vendors and biggest global accounting firms mentioned above) find ways to optimize and streamline your implementation and provide a detailed plan that addresses any issues or discrepancies flagged in your solution’s design. It further accelerates the migration or implementation. And more importantly, it makes sure your tax engine runs better and faster for longer, reducing your ongoing maintenance cost.

I invite you to sign up for a demo of our Modios, Rapid Testing, Rapid Insight or Rapid Insight Plus solutions. See for yourself how Cordiance is upending the accounting industry’s expectations around the time and cost required to implement a flawless tax engine solution.

Cordiance LLC maintains this website exclusively for informational purposes. It is not professional advice and does not necessarily represent the opinion of Cordiance LLC or its clients. Viewing this site, using information from it, or digitally communicating with Cordiance LLC through this site does not create a client relationship between you and Cordiance LLC.